Quant Small Cap Fund: Direct Growth, Direct Plan Growth, Regular Growth & Review

When it comes to aggressive wealth-building over the long term, small cap funds are often considered a high-risk, high-reward strategy. Among the many options in India, the Quant Small Cap Fund has emerged as a bold player that often defies traditional fund management styles. Whether you’re exploring the Quant Small Cap Fund direct growth, comparing it with the Quant Small Cap Fund direct plan growth, or considering the Quant Small Cap Fund regular growth, understanding the fund holistically is key. In this detailed Quant Small Cap Fund review, we’ll decode each variant, analyze the strategy, and share insights most investors haven’t yet discovered.

Quant Small Cap Fund Direct Growth

The Quant Small Cap Fund direct growth option is designed for investors who prefer a cost-effective route without distributor commissions. One little-known aspect of this fund is its use of “predictive analytics” in stock selection. Unlike traditional small cap funds that bet heavily on future earnings, this fund often identifies market inflection points by combining technical indicators with macro data. This approach allows the fund to enter and exit positions more dynamically—something direct investors should pay attention to.

This variant is best suited for hands-on investors who want to avoid paying extra fees and are confident in staying invested during volatile phases. The lower expense ratio compared to regular plans also means that over 10+ years, the compounding benefits can be significantly higher. (Read: SBI contra fund complete guide)

Quant Small Cap Fund Direct Plan Growth

While most investors see Quant Small Cap Fund direct plan growth as just another low-cost option, few realize how the fund’s structure allows it to be hyper-reactive to macroeconomic shifts. For instance, in 2023, while many small cap funds remained overweight on micro-finance and chemical sectors, this fund quietly shifted to defence and infrastructure—moves that were not just tactical, but driven by macro-cycle interpretations rarely used in mutual funds.

The direct plan growth version is ideal for goal-based investing where the investor doesn’t need periodic payouts and is comfortable navigating market turbulence without emotional reactions. It’s not just about cost-saving—it’s about trusting a fund that behaves differently from the crowd.

Quant Small Cap Fund Regular Growth

The Quant Small Cap Fund regular growth plan is more suited for investors who prefer advisory or distribution support, often through financial intermediaries. While the expense ratio is higher here,

it comes with the advantage of personalized advice and easier onboarding for non-tech-savvy investors.

One under-discussed feature is that many regular investors stick with the fund longer than direct investors—often because of guided emotional management during market dips. This unintentional behavioral edge has led to more consistent SIP (Systematic Investment Plan) inflows over the years, and surprisingly better personal return outcomes compared to the direct plan for some retail investors. (Read: Is HDF defence fund a good option)

So, while regular growth might seem like the costlier option on paper, the human advice element can often be the hidden alpha.

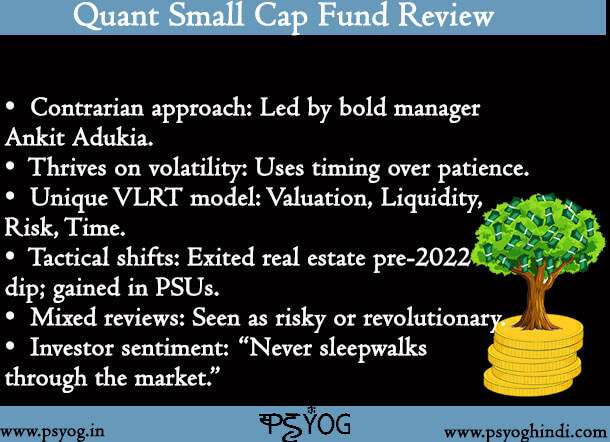

Quant Small Cap Fund Review

In this Quant Small Cap Fund review, we’ll go beyond surface-level metrics and talk about what truly makes this fund different.

Managed by the bold and contrarian Ankit Adukia, Quant Mutual Fund has built a reputation for turning the typical fund strategy on its head. The Small Cap Fund, in particular, doesn’t blindly follow momentum. It thrives on volatility. While many AMCs (Asset Management Companies) preach patience, Quant focuses on timing—using a proprietary “VLRT” framework (Valuation, Liquidity, Risk appetite, Time) to rotate its sectoral allocation.

In one instance, the fund exited real estate just weeks before a major downturn in 2022 and reallocated to PSUs (Public Sector Undertakings), gaining more than 30% in a single quarter. That’s not luck—that’s calculated aggression.

Ratings agencies like Value Research and Morningstar are divided about Quant’s style—some call it risky, others revolutionary. But ask seasoned investors who’ve stuck with Quant for over three years, and you’ll often hear this: “It’s the only fund that doesn’t sleepwalk through the market.”

Conclusion

The Quant Small Cap Fund isn’t just another small cap offering—it’s a fund that thinks differently, acts swiftly, and plays to win. Whether you opt for the direct growth, direct plan growth, or regular growth version depends entirely on your experience, comfort with volatility, and investing behavior. (Read: Parag Parikh flexi cap fund review and more)

If you’re looking for a fund that combines aggressive growth with tactical agility, and you’re ready to embrace the risks, this one deserves a spot on your radar. Just don’t expect it to follow the herd—Quant dances to its own rhythm, and that might just be its biggest strength.

FAQs

Is Quant Small Cap a good investment?

Yes, if you have a high-risk appetite and a long-term horizon. The fund’s unique strategy can deliver exceptional returns but also comes with sharp fluctuations.

Is it safe to invest in Quant fund?

It’s relatively safe for informed investors who understand market cycles. Quant funds are well-regulated, but their aggressive allocation style means they’re not ideal for conservative investors.

What are the returns of Quant Small Cap Fund?

As of recent data, the fund has delivered 30%+ CAGR over 3 years and has outperformed many peers. However, returns vary significantly depending on market timing and holding period.